🌍 Global Financial Markets Trading: Learn to Trade from A to Z

- Antonio Carlos Faustino

- Sep 15

- 4 min read

Updated: Sep 16

Introduction: Why Global Financial Markets Trading Matters Today

In the era of digital finance, global financial markets trading is no longer the privilege of large institutions or hedge funds. Today, individual investors across the United States and the United Kingdom can access global equities, forex, commodities, and crypto markets instantly from their smartphones.

But accessibility does not equal simplicity. While platforms and apps promise quick entry, successful trading demands a structured approach—an education “from A to Z.” This article offers a critical, humanized perspective on how markets truly work, the differences between U.S. and U.K. regulations, strategies, risks, and the future of international investing.

“Financial markets are not casinos, but complex ecosystems that reward preparation and discipline” (MINSKY, 1986).

Understanding Global Financial Markets Trading

At its core, global financial markets trading means participating in the exchange of financial instruments across different regions of the world. This includes:

Equities – shares of companies listed in New York (NYSE, NASDAQ) or London (LSE).

Foreign exchange (Forex) – trading currencies like USD/GBP or USD/EUR.

Derivatives – futures, options, and contracts for difference (CFDs).

Commodities – gold, oil, agricultural products.

Digital assets – Bitcoin, Ethereum, tokenized securities.

The rise of global connectivity means that geopolitical events in Asia, policy changes in Washington, and interest rate decisions in London can all ripple through global markets instantly.

The Rise of Accessibility: From Wall Street to Your Phone

Until the late 1990s, entering financial markets required a broker, a significant amount of capital, and insider access. Today, trading apps like Robinhood (U.S.) or eToro (U.K. and Europe) allow anyone to start with as little as $10.

Key drivers of accessibility include:

Zero-commission models (pioneered in the U.S.).

Global platforms offering multi-asset portfolios.

Educational democratization via online courses and YouTube channels.

Yet, accessibility is a double-edged sword. According to FINRA (2023), 72% of new U.S. retail traders underperform the market due to lack of strategy and overuse of leverage.

Comparing the U.S. and U.K. Trading Landscapes

Though interconnected, the U.S. and U.K. markets operate under distinct regulatory and cultural frameworks.

United States (SEC, CFTC, FINRA):

Strong investor protection laws.

Dominated by tech giants and dollar-denominated assets.

High adoption of derivatives and options trading.

United Kingdom (FCA, PRA):

Historically a hub for forex and commodities.

More conservative retail participation.

FCA crackdowns on high-leverage products (since 2019).

For investors, this means that while the U.S. offers high-risk/high-reward opportunities (such as options trading), the U.K. provides a more regulated environment with a focus on long-term sustainability.

Key Strategies for Global Traders

Global financial markets trading requires clear strategies tailored to risk appetite:

Swing Trading: Holding positions from days to weeks. Effective for global equities reacting to macroeconomic events.

Day Trading: Intraday speculation on high-volume instruments (popular in the U.S.).

Forex Scalping: Common in London’s 24-hour FX market, focusing on small price fluctuations.

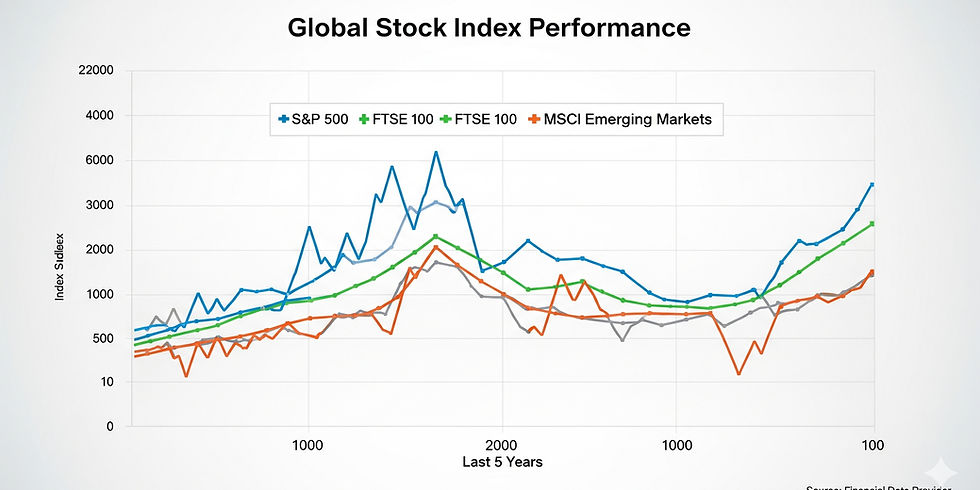

ETF Diversification: Tracking global indices (e.g., S&P 500, FTSE 100, MSCI Emerging Markets).

Hedging with Commodities: Using gold or oil to balance portfolios.

Platforms and Tools You Need

A trader’s success depends heavily on tools. Beginners often underestimate the value of charting platforms, economic calendars, and professional-grade analytics.

🔹 Recommended Amazon Products (Affiliate: ancafa1968-20):

Technical Analysis of the Financial Markets by John J. Murphy — Buy on Amazon

Market Wizards by Jack D. Schwager — Buy on Amazon

Dual-Screen Portable Monitor for Traders — Buy on Amazon

🔹 Hotmart Infoproduct Suggestions:

Forex from Zero to Pro (course in English).

Day Trading Masterclass (U.S. market focus).

Investing Psychology 101 (emotional control for traders).

Risks and Realities of Trading

Trading is often glamorized, but the reality is sobering.

Leverage traps: Many retail traders in the U.K. lost 70–90% of their capital due to CFDs (FCA, 2021).

Psychological strain: Stress, decision fatigue, and gambling tendencies.

Volatility: Events like Brexit, the 2020 pandemic, and the 2023 banking crisis show how quickly markets can turn.

Responsible traders adopt risk management strategies such as stop-loss orders, diversified portfolios, and strict exposure limits.

Case Studies and Data: U.S. vs. U.K.

S&P 500 vs. FTSE 100 (2024): While the S&P 500 surged by 15% due to AI-driven growth, the FTSE 100 remained flat, impacted by inflationary pressures and sluggish GDP growth in the U.K.

USD vs. GBP: The dollar strengthened against the pound after Federal Reserve rate hikes in 2023, underscoring the importance of monitoring global monetary policy.

Crypto adoption: The U.S. led institutional adoption, while U.K. regulators imposed stricter guidelines on retail crypto promotions.

Building a Sustainable Path From A to Z

Trading “from A to Z” means building a full-cycle approach:

A: Awareness – Understanding global markets and your goals.

B: Basics – Mastering terminology, platforms, and simple strategies.

C: Capital discipline – Only trade with money you can afford to risk.

D: Data analysis – Using reliable sources (Bloomberg, Reuters).

Z: Zero illusions – Trading is not quick wealth; it’s a long-term skill.

“Markets reward patience, not impulsiveness” (KEYNES, 1936).

Final Thoughts: Why Global Financial Markets Trading Shapes the Future of Wealth

Global financial markets trading is more than speculation. It is the bridge that connects individuals to the flow of capital across continents. For Americans and Britons alike, mastering this discipline can unlock opportunities that transcend borders.

📢 CTA: Stay updated with critical insights, data-driven analysis, and opportunities by following Bom Dia América. Support here independent content production here that brings the Americas closer to you.

References

FINRA. Retail Investor Risk Study 2023. Washington, DC: Financial Industry Regulatory Authority, 2023.

FCA. Retail CFD Trading Report. London: Financial Conduct Authority, 2021.

KEYNES, John Maynard. The General Theory of Employment, Interest and Money. London: Macmillan, 1936.

MINSKY, Hyman. Stabilizing an Unstable Economy. New Haven: Yale University Press, 1986.

Comments